Amelia Island, FL, Ritz Carlton Resort, October 20, 2025: Newport Beach-based securities attorney Montgomery G. Griffin was a featured speaker today at the Annual Meeting of the Public Investor’s Advocate Bar Association (PIABA). Monty was selected from PIABA’s national membership of approximately 350 lawyers to present to its membership and other attending industry regulators (including several of FINRA Dispute Resolution’s top brass), expert witnesses, mediators, and scholars on the topic of “Drafting Effective Statements of Claim.”

Amelia Island, FL, Ritz Carlton Resort, October 20, 2025: Newport Beach-based securities attorney Montgomery G. Griffin was a featured speaker today at the Annual Meeting of the Public Investor’s Advocate Bar Association (PIABA). Monty was selected from PIABA’s national membership of approximately 350 lawyers to present to its membership and other attending industry regulators (including several of FINRA Dispute Resolution’s top brass), expert witnesses, mediators, and scholars on the topic of “Drafting Effective Statements of Claim.”

Monty has earned a national reputation as a strong advocate for his clients, beginning with his preparation of the arbitration Statement of Claim. Monty leverages his 10 years of prior experience as a financial advisor employed by two of Wall Street’s largest firms to thoroughly analyze the facts and circumstances giving rise to each dispute and understand the extent of the advisor’s misconduct before drafting a detailed Statement of Claim. Regarding his speaking engagement for PIABA, he stated: “Although FINRA rules only require a valid Statement of Claim to specify the relevant facts and remedies requested, the reality of the moment is that the SOC is the aggrieved investor’s first opportunity to begin convincing the arbitrators (and the brokerage or advisory firm) that an injustice has occurred, making it the perfect time for the author to demonstrate his or her mastery of a potentially complex set of accounts and events. But the devil in these cases is in the detail and understanding them requires a deep dive.”

The Four Keys to Initially Analyzing a Potential New Case:

- Interview #1 of the prospective new client/case. This usually consists of a discussion with the prospective client of between 1-2 hours.

- Obtain and review core documents from the prospective client. This typically includes monthly statements, e-mails the client exchanged with the financial advisor, and account agreements.

- Have a preliminary forensic damages report prepared for inclusion in ongoing case analysis and calculation of the economic damages, including the market-adjusted (or “well managed”) damages.

- Interview #2 with the prospective client. Completion of steps 1, 2, and 3 provide Monty with a much deeper understanding of the events and occurrences that took place, as well as the amount of the damages caused.

It is only after these four critical tasks have been completed that a Statement of Claim can most effectively be prepared.

Three Core Elements to Drafting an Effective Statement of Claim:

- Open strong, assert a theme. Monty believes that too many attorneys begin their SOCs by setting forth basic, mundane information instead of seizing the moment by capturing the attention of the reader with a brief, yet insightful, depiction of the case that has already been revealed through the 1-2-3-4 process above.

- Be mindful of your audience—to whom do you seek to appeal the most? The SOC should be designed to appeal to the arbitrator(s), the opposing counsel, the client, and (in some cases) the insurance company representative. To optimize the presentation to these sophisticated readers, the SOC should be well organized and present salient details of how the investment advisor breached his or her fiduciary duties to the client, and specific standards in the industry that were not met, including supervisory duties.

- Set forth the details. Although persuasive writing undoubtedly is always an important aspect of any pleading, Statements of Claim are most likely to resonate with the reader when they include details of how the client was cheated. These can simply be described, or they can also be packaged visually to facilitate the reader’s understanding and comprehension of them. Three examples of this are:

(1) Include tables of critical information (for example, “The Increasingly Excessive Concentration In Energy Stocks Each Year” or “The Transformation of the Suitable Portfolio Received by the Broker Into the Patently Unsuitable Portfolio Constructed”) (see below for examples of tables to include in a Statement of Claim);

(2) Include simple lists of key information (for example, a list of “everything the Brokerage Firm knew about the client when it recommended allocating 75% of the account value into high-risk technology stocks” or “Claimant’s medical challenges at the time the portfolio was constructed”); and

(3) Include a summary of “red flags” ignored by branch management. Every client is entitled to have his or her account and financial advisor adequately supervised by the brokerage or advisory firm.

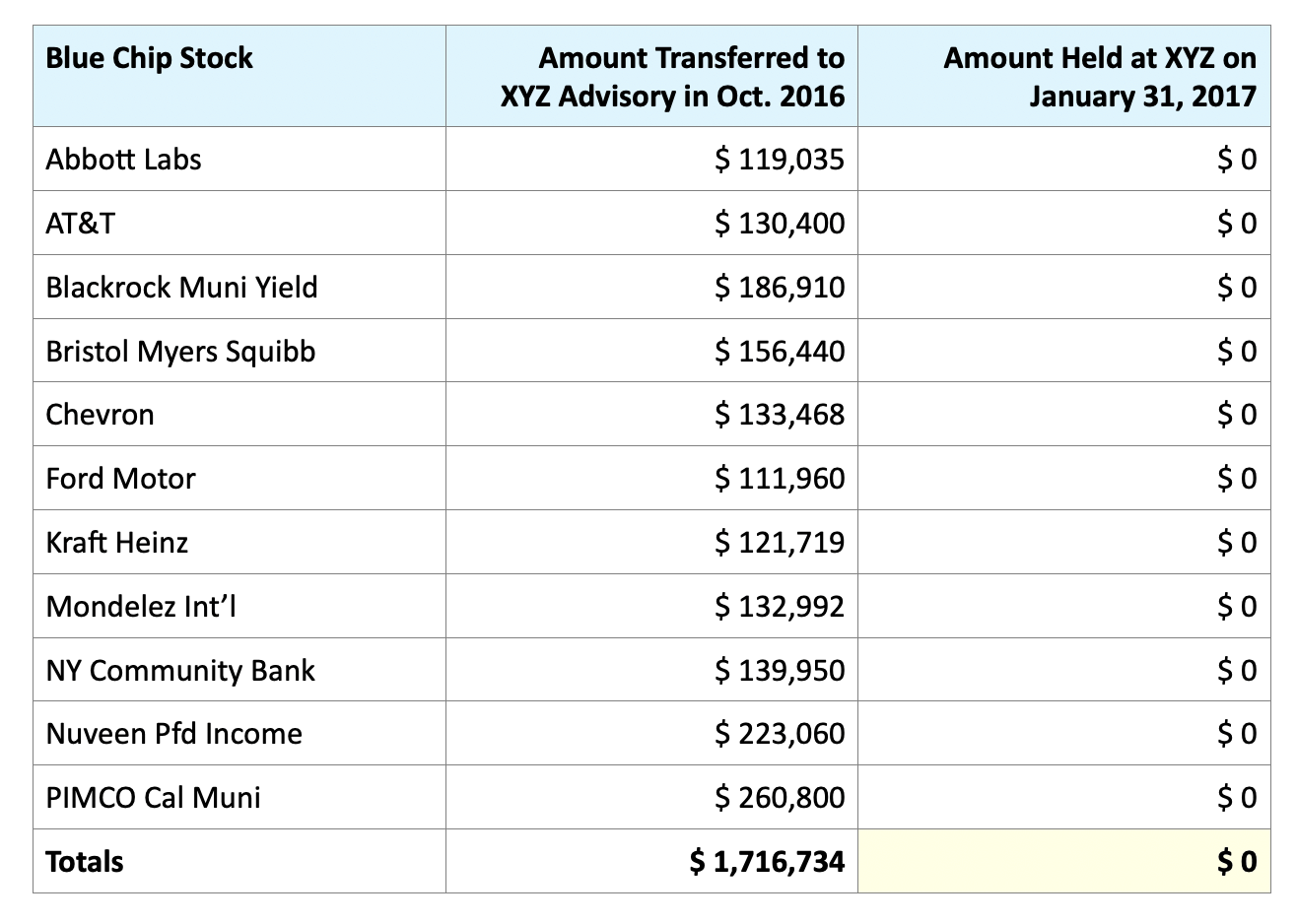

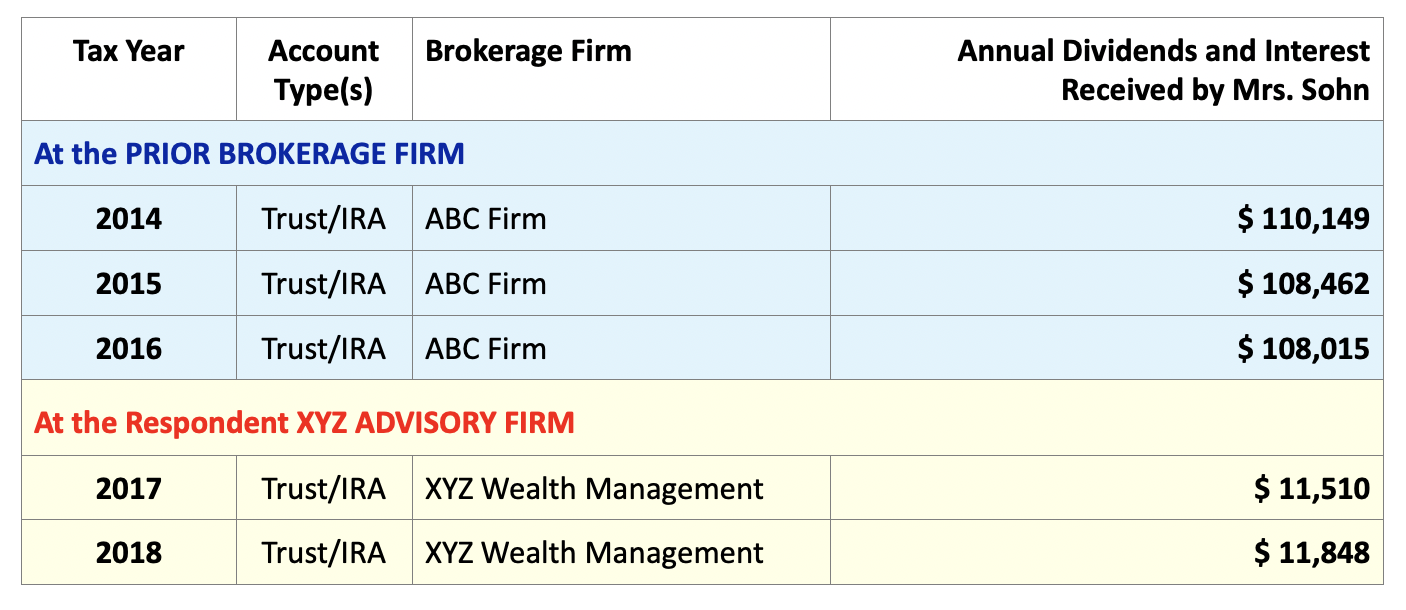

Examples of types of tables appropriate for inclusion in a Statement of Claim include those two below. These tables related to a case where, like often is the case, the client transferred their portfolio from Firm A to Firm B. Thereafter, the financial advisor at Firm B convinced the client to sell her blue-chip stocks and reallocate the funds into new securities—which were unsuitable for the client—selected by the new advisor. The reconstruction also resulted in a severe depletion of dividend and interest income for the client.

Sample Table #1

XYZ Wealth Management’s Late-2016 Demolition of Mrs. Sohn’s Blue-Chip Portfolio

Sample Table #2

XYZ’s Reconstruction of Mrs. Sohn’s Accounts Caused a 90% Reduction of

Her Portfolio’s Annual Income

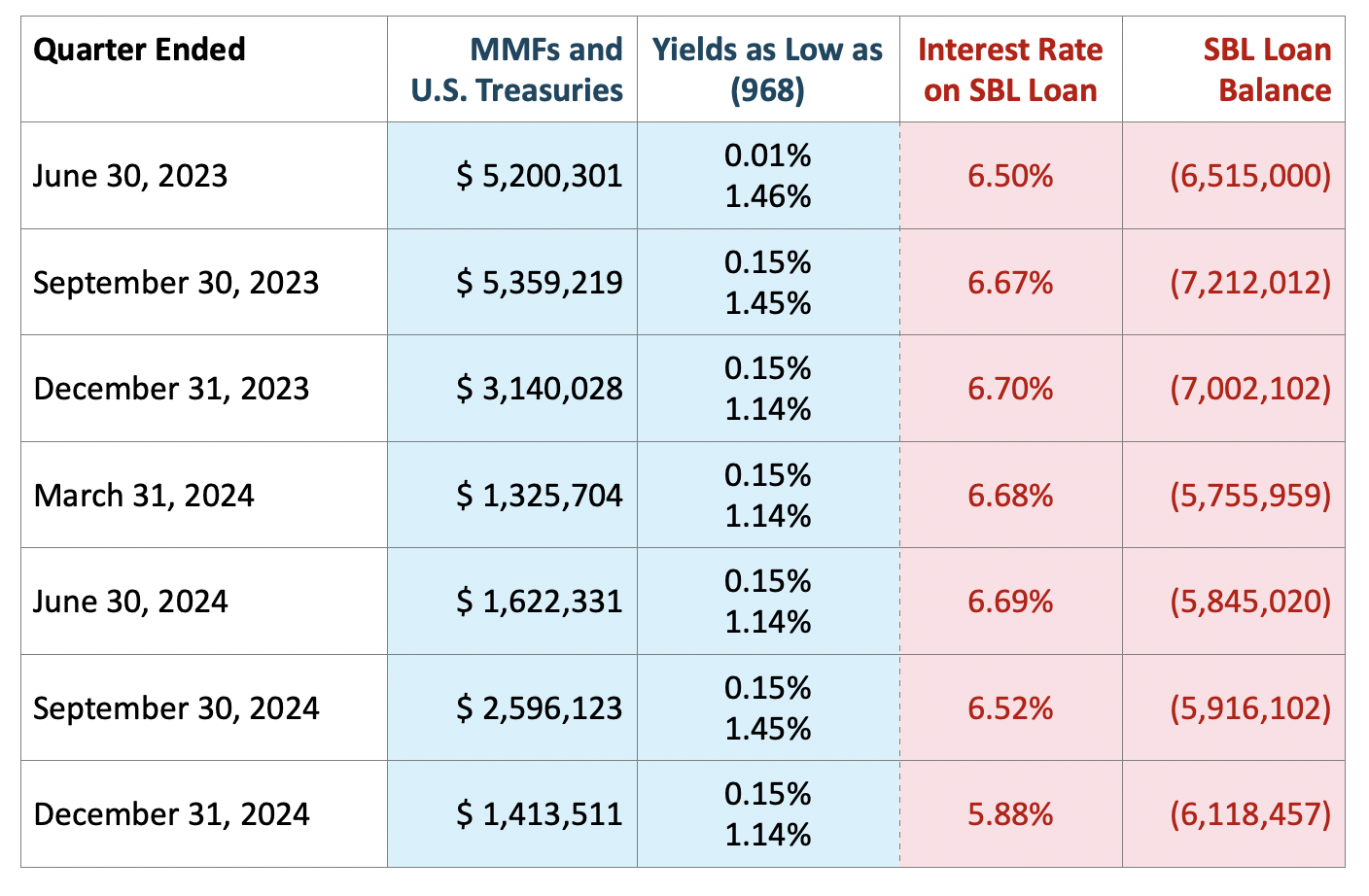

Sample Table #3

Sample Table 3 below exemplifies for the reader just how nonsensical the investment recommendation was for the client to borrow over $6 million on a securities-based loan (“SBL”) against the client’s investment portfolio. Incredibly, the borrowing rate of interest was always 6.5% or higher while the client was concurrently advised to hold millions of dollars in money market funds and short-term U.S. Treasury securities – a strategy that insured ongoing losses for the client, but big interest loan revenues for the firm on the unnecessary SBL.

Red Flags of SBL Abuse/Unsuitable Investment Strategy

Statistics Exemplifying the Period of Financial Abuse

The Law Offices of Montgomery G. Griffin concentrate on recovering investment losses and other damages for aggrieved investors against their former brokers and financial advisors through arbitration claims or court cases where securities fraud and/or financial misconduct has occurred. If you suspect your financial advisor has engaged in misconduct, please contact us for a preliminary evaluation at 949-721-9781.